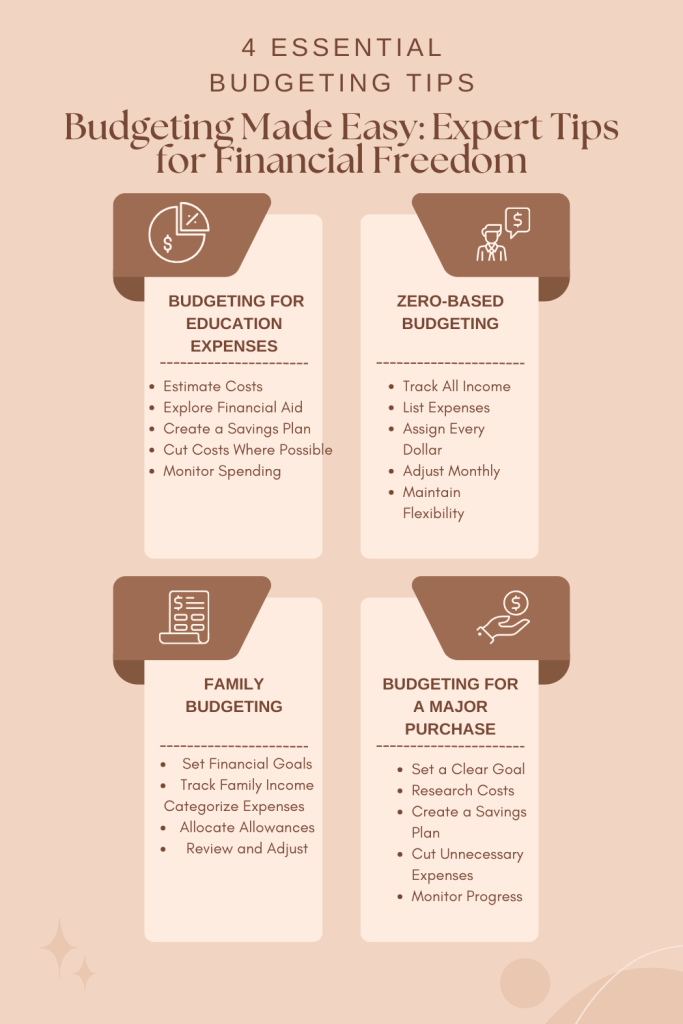

Effective budgeting is essential for financial stability and achieving long-term goals. Here, we delve into four specific budgeting strategies: managing education expenses, implementing zero-based budgeting, family budgeting, and preparing for major purchases.

1. Budgeting for Education Expenses

Education is a significant investment, and planning for it can help alleviate the financial burden. Here’s how to budget effectively for education expenses:

- Estimate Costs: Start by estimating the total cost of education, including tuition, books, supplies, accommodation, and other related expenses. Consider both direct costs (like tuition fees) and indirect costs (like transportation and personal expenses).

- Explore Financial Aid: Look into scholarships, grants, and student loans. Many institutions offer financial aid packages, and external scholarships can significantly reduce the financial burden.

- Create a Savings Plan: Start saving early. Utilize education savings accounts like 529 plans, which offer tax advantages. Set aside a specific amount each month to build up your education fund.

- Cut Costs Where Possible: Consider cost-saving options such as attending community college for the first two years, buying used textbooks, or living at home to save on accommodation costs.

- Monitor Spending: Keep track of all education-related expenses to ensure you stay within budget. Regularly review your budget and adjust as necessary to accommodate any changes in expenses or income.

2. Zero-Based Budgeting

Zero-based budgeting (ZBB) is a method where every dollar of income is allocated to a specific expense, savings, or debt repayment category. Here’s how to implement it:

- Track All Income: List all sources of income, including salary, side jobs, and any other revenue streams.

- List Expenses: Write down all monthly expenses, including fixed costs (rent, utilities), variable costs (groceries, entertainment), and occasional expenses (car repairs, medical bills).

- Assign Every Dollar: Allocate every dollar of your income to a specific category until you reach zero. This ensures that every part of your income is purposefully directed.

- Adjust Monthly: At the end of each month, review your budget. If you overspend in one category, reallocate funds from another category to balance the budget.

- Maintain Flexibility: While ZBB is strict, it’s important to be flexible. Adjust your budget categories as your financial situation or priorities change.

3. Family Budgeting

Family budgeting involves managing household finances to meet the needs of all family members and achieve common financial goals. Here’s how to effectively budget for a family:

- Set Financial Goals: Involve all family members in setting financial goals, such as saving for a vacation, a new car, or a down payment on a house. Having shared goals fosters cooperation and commitment.

- Track Family Income: Combine all sources of income from each family member. This includes salaries, side jobs, and any other financial contributions.

- Categorize Expenses: List all family expenses, categorizing them into needs (housing, groceries, utilities) and wants (entertainment, dining out). Ensure essential expenses are covered first.

- Allocate Allowances: Give each family member a specific allowance for personal spending. This helps manage individual expenses and avoids overspending.

- Review and Adjust: Hold monthly family budget meetings to review expenses and adjust the budget as needed. Involving the entire family ensures transparency and shared responsibility.

4. Budgeting for a Major Purchase

Planning for major purchases, like a home, car, or significant investment, requires careful budgeting to ensure financial stability. Here’s how to budget for such expenses:

- Set a Clear Goal: Define the major purchase you’re saving for and establish a timeline. Knowing your goal helps you determine how much you need to save each month.

- Research Costs: Understand the total cost of the purchase, including hidden expenses like taxes, maintenance, and insurance.

- Create a Savings Plan: Determine how much you need to save each month to reach your goal within your desired timeframe. Consider opening a separate savings account to avoid spending this money on other expenses.

- Cut Unnecessary Expenses: Identify areas where you can reduce spending to allocate more funds towards your major purchase. This could mean dining out less, canceling unused subscriptions, or shopping for deals.

- Monitor Progress: Regularly check your savings progress and adjust your budget if necessary. Stay disciplined and avoid using the saved money for other purposes.

By adopting these budgeting strategies, you can manage your finances more effectively, achieve your financial goals, and ensure a stable financial future. Whether you’re planning for education, managing a family budget, or preparing for a major purchase, careful planning and disciplined budgeting are key to financial success.

Leave a comment