Create a Budget: The Foundation of Financial Self-Care

Financial self-care is about more than just saving money; it’s about creating a sustainable and healthy relationship with your finances. One of the most fundamental steps in achieving this is by creating a budget. A well-constructed budget can help you take control of your finances, reduce stress, and plan for the future. Here’s how to create a budget that works for you.

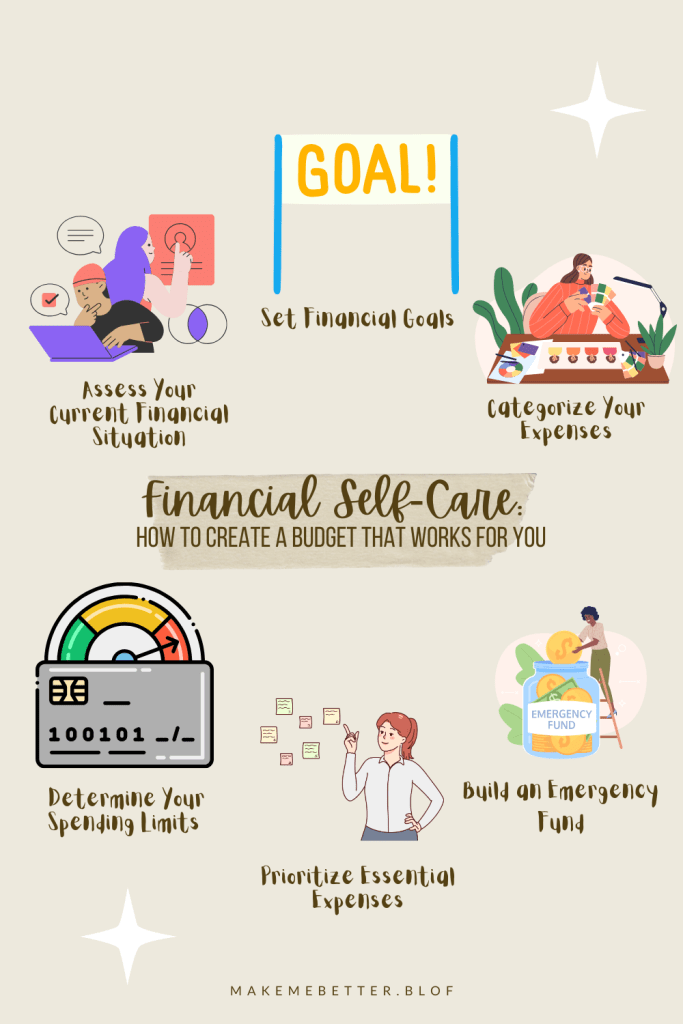

1. Assess Your Current Financial Situation

Before you can create a budget, you need to understand your current financial situation. Start by listing all your sources of income, including your salary, freelance work, investment returns, and any other money you receive regularly. Next, track all your expenses for a month to get a clear picture of where your money is going. This includes fixed expenses (like rent, utilities, and loan payments) and variable expenses (like groceries, dining out, and entertainment).

2. Set Financial Goals

Having clear financial goals can guide your budgeting process and give you a sense of purpose. Your goals can be short-term (like saving for a vacation), medium-term (like paying off debt), or long-term (like building a retirement fund). Write down your goals and prioritize them. Knowing what you’re working towards can help you make better financial decisions.

3. Categorize Your Expenses

Organize your expenses into categories to get a better understanding of your spending patterns. Common categories include:

- Housing: Rent or mortgage, utilities, maintenance

- Transportation: Car payments, gas, public transit

- Food: Groceries, dining out, snacks

- Insurance: Health, auto, home

- Debt Repayment: Credit cards, student loans, personal loans

- Savings: Emergency fund, retirement, specific savings goals

- Entertainment: Hobbies, subscriptions, outings

- Miscellaneous: Clothing, personal care, gifts

4. Determine Your Spending Limits

Based on your income and expenses, allocate a specific amount of money to each category. This is where you set spending limits to ensure you’re not overspending. Be realistic with your limits—cutting back too drastically can make the budget hard to stick to.

5. Prioritize Essential Expenses

Ensure that your essential expenses (like housing, food, and transportation) are covered first. These are non-negotiable costs that you need to live. Once these are accounted for, you can allocate funds to non-essential categories and savings.

6. Build an Emergency Fund

An essential part of any budget is an emergency fund. This is money set aside for unexpected expenses like medical bills, car repairs, or job loss. Aim to save at least three to six months’ worth of living expenses. Start by setting aside a small amount each month until you reach your goal.

7. Track Your Spending

Once your budget is set, it’s crucial to track your spending to ensure you’re staying within your limits. Use a budgeting app, spreadsheet, or a notebook to record every expense. Regularly review your spending to see where you might need to adjust your budget.

8. Review and Adjust Your Budget

Your financial situation and goals may change over time, so it’s important to review your budget regularly. At the end of each month, compare your actual spending to your budgeted amounts and make adjustments as needed. If you consistently overspend in one category, consider reallocating funds from another category.

9. Celebrate Your Progress

Building a healthier relationship with money is a journey, and it’s important to celebrate your progress along the way. When you reach a financial milestone, reward yourself in a way that doesn’t derail your budget. This could be a small treat or a planned purchase that you’ve been saving for.

Creating a budget is a powerful tool for financial self-care. It allows you to take control of your finances, reduce stress, and work towards your financial goals. By assessing your current situation, setting clear goals, categorizing expenses, and regularly reviewing your budget, you can build a healthier relationship with your money and achieve greater financial well-being. Start today, and take the first step towards a more secure and fulfilling financial future.

Leave a comment