Cryptocurrency has come a long way from being a niche interest to becoming a significant player in global finance. While the market remains volatile, the potential for growth and innovation is enormous. As we look toward the future, several key trends are expected to shape the cryptocurrency landscape. These developments could impact how we trade, invest, and interact with money. Let’s dive deeper into these trends and predictions for the future of cryptocurrency.

1. Institutional Adoption on the Rise

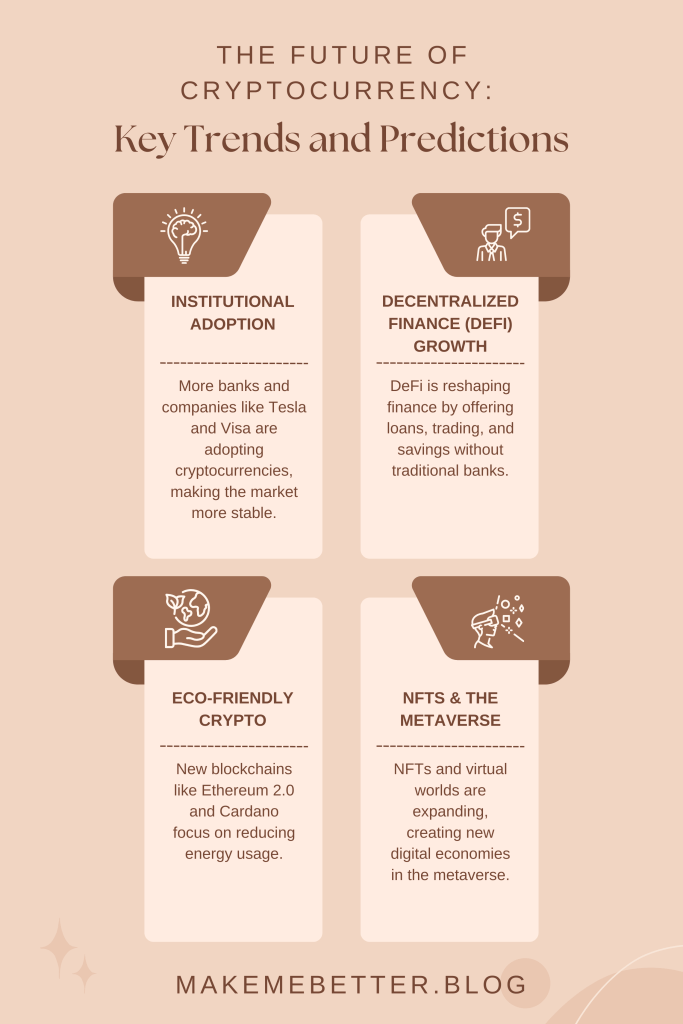

In the early days of cryptocurrency, it was mostly tech enthusiasts and retail investors driving the market. However, over the last few years, we’ve seen a growing interest from institutional investors like hedge funds, banks, and large corporations. This shift is significant because it brings legitimacy and stability to the market.

Large companies like Tesla and MicroStrategy have added Bitcoin to their balance sheets, while major payment processors like PayPal and Visa are enabling crypto transactions. Institutional adoption means more liquidity in the market, which can help reduce volatility and make cryptocurrency a more stable investment.

Moreover, with institutions getting involved, we’re likely to see more financial products tailored to crypto, such as exchange-traded funds (ETFs), futures, and derivatives. These products make it easier for traditional investors to gain exposure to cryptocurrency without directly owning it.

Why It Matters:

Institutional adoption acts as a seal of approval for cryptocurrency. As more well-established companies and financial institutions participate in the market, public trust in cryptocurrencies will likely increase, making it more accessible to everyday investors.

2. The Growing Impact of Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is one of the most transformative innovations in the crypto space. DeFi refers to a broad category of financial services built on blockchain technology that operates without traditional intermediaries like banks or brokers. This allows users to lend, borrow, trade, and earn interest on their crypto holdings directly through decentralized platforms.

What’s groundbreaking about DeFi is that it democratizes access to financial services. For example, anyone with an internet connection can take out a loan on a DeFi platform without going through a bank or having a credit score. Some of the most popular DeFi platforms, like Uniswap and Aave, have seen billions of dollars flow through them in recent years.

As the DeFi ecosystem grows, we’re likely to see more sophisticated financial products being developed. Innovations like yield farming (earning interest by providing liquidity) and synthetic assets (tokenized versions of real-world assets) will continue to blur the lines between traditional finance and the crypto world.

Why It Matters:

DeFi has the potential to disrupt the entire financial industry by offering open, transparent, and efficient alternatives to traditional banking services. This could lead to a more inclusive global financial system.

3. Environmental Concerns and Solutions

Cryptocurrency, particularly Bitcoin, has faced criticism for its high energy consumption. Bitcoin’s mining process, which uses a proof-of-work (PoW) consensus mechanism, requires significant computational power, resulting in a substantial carbon footprint. This has led to debates about the environmental sustainability of cryptocurrencies.

In response, there’s growing interest in more energy-efficient consensus mechanisms, such as proof-of-stake (PoS). Ethereum, the second-largest cryptocurrency by market capitalization, has transitioned to Ethereum 2.0, which utilizes PoS to significantly reduce its energy consumption. Other blockchains, like Cardano and Polkadot, are also built with PoS to be more eco-friendly from the start.

Additionally, some projects are exploring the use of renewable energy sources for mining operations, and others are creating carbon offset programs to balance their environmental impact.

Why It Matters:

Environmental concerns could shape the future of cryptocurrency, driving innovation toward more sustainable blockchain technologies. Energy-efficient solutions will be critical for the long-term viability and global adoption of cryptocurrency.

4. Increasing Government Regulation

As cryptocurrency gains mainstream attention, governments around the world are stepping up efforts to regulate the industry. In the past, the crypto space operated in a regulatory gray area, but that is rapidly changing.

Countries like the United States and the European Union are developing comprehensive frameworks to regulate cryptocurrency exchanges, token offerings, and financial transactions. The goal is to protect investors, prevent fraud, and combat illegal activities such as money laundering.

While some crypto enthusiasts view regulation as a negative development, it could also bring long-term benefits. Clearer regulations would reduce uncertainty for businesses and investors, encouraging broader adoption of cryptocurrency. However, regulations also pose risks, as overly strict rules could stifle innovation and limit the potential of decentralized systems.

Why It Matters:

Government regulation will shape the future of cryptocurrency by balancing the need for investor protection with the need to foster innovation. This could bring more stability to the market but may also introduce challenges for decentralized projects.

5. The Continued Growth of NFTs and the Metaverse

Non-Fungible Tokens (NFTs) took the world by storm in 2021, revolutionizing how we think about ownership of digital assets. NFTs are unique digital tokens that represent ownership of a specific item or piece of content, such as art, music, or virtual real estate. Built on blockchain technology, NFTs enable creators to monetize their work in new and innovative ways.

Looking ahead, NFTs are expected to evolve beyond collectibles and art. The gaming industry is already exploring how NFTs can be used to give players ownership of in-game assets, and the concept of the metaverse—a shared virtual world where users interact using digital avatars—will likely accelerate this trend.

Cryptocurrencies and NFTs will play a crucial role in the development of the metaverse, enabling users to buy, sell, and trade virtual goods across platforms. Projects like Decentraland and The Sandbox are at the forefront of building these virtual worlds, with entire economies forming within them.

Why It Matters:

NFTs and the metaverse represent new frontiers for blockchain technology. The potential for digital ownership and virtual economies is enormous, and this could lead to the creation of new markets and industries within the crypto space.

What to Expect as the Crypto Market Evolves

The future of cryptocurrency is full of potential, but it also comes with challenges. As the market continues to evolve, here’s what investors and enthusiasts should keep in mind:

- Greater Stability: Institutional adoption and government regulation could bring more stability to the notoriously volatile cryptocurrency market, making it a more viable investment for the long term.

- Continued Innovation: Expect to see more innovation in blockchain technology, from eco-friendly consensus mechanisms to new DeFi applications and digital economies in the metaverse.

- Wider Adoption: As more people become comfortable with using cryptocurrency for everyday transactions, we could see cryptocurrencies become a more integrated part of the global financial system.

Ultimately, the future of cryptocurrency will depend on how it navigates the balance between decentralization, innovation, and regulation. For investors, staying informed and adaptable is the key to success in this fast-evolving space.

Ready to invest in cryptocurrency? Start with eToro today and explore a range of crypto assets. Sign up now and begin your journey!

Leave a comment