When it comes to investing, one of the most important decisions you’ll make is choosing between active and passive strategies. Both have their benefits and potential drawbacks, and the best choice often depends on your investment goals, time commitment, and risk tolerance. Let’s dive into the core differences between passive and active investing, along with some pointers to help you decide which one aligns best with your financial aspirations.

What is Passive Investing?

Passive investing is a long-term strategy aimed at minimizing buying and selling. Rather than frequently trading, passive investors typically hold onto investments over the years, often through index funds or ETFs that mirror a particular market index, such as the S&P 500.

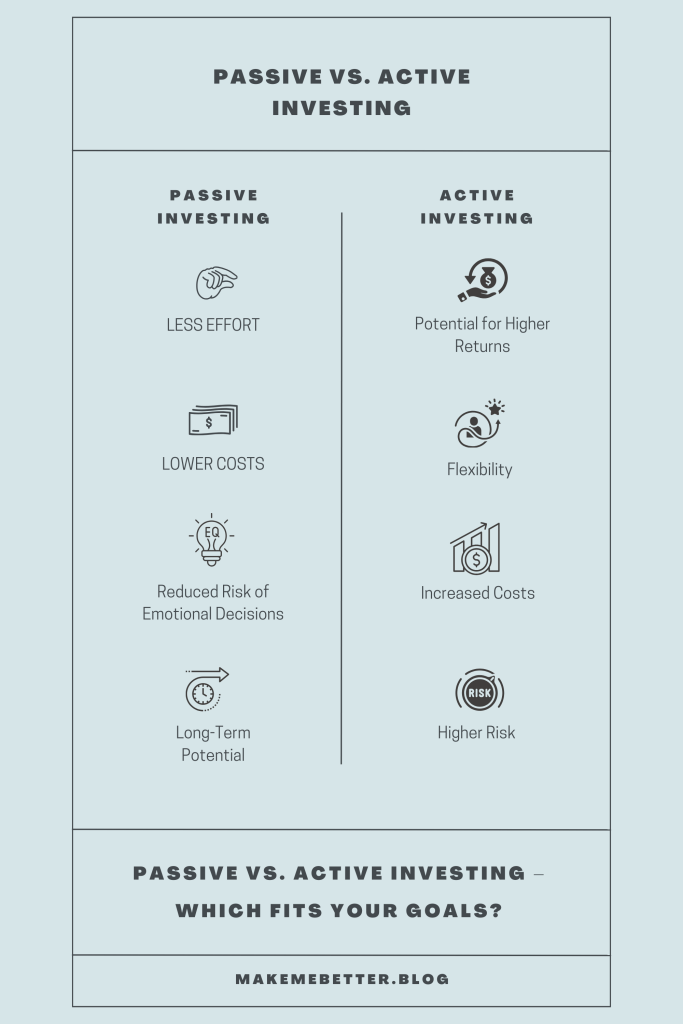

The goal of passive investing is to match market performance rather than try to outperform it. Here are some of its main characteristics:

- Lower Costs

Passive investing usually involves fewer fees since there’s less buying and selling, which minimizes transaction costs. Additionally, passively managed funds often have lower expense ratios compared to actively managed ones. - Less Effort

Once you’ve invested in a passively managed fund, there’s little day-to-day management required. This hands-off approach is ideal for investors who prefer a “set-it-and-forget-it” method. - Reduced Risk of Emotional Decisions

With passive investing, you’re less likely to be affected by market fluctuations, which can help you avoid making emotionally driven decisions that might hurt your returns. - Long-Term Potential

Passive investing allows you to benefit from the compounding effect of holding investments for the long haul, making it a great option for people with long-term financial goals, such as retirement.

What is Active Investing?

Active investing, as the name suggests, requires a hands-on approach where investors or fund managers actively buy and sell stocks, bonds, or other assets to outperform the market. The primary goal of active investing is to generate returns that beat a specific benchmark or index.

- Potential for Higher Returns

Active investors aim to capitalize on short-term price fluctuations to potentially outperform the market, which can result in higher returns. However, this approach requires skill, research, and sometimes a bit of luck. - Flexibility

With active investing, investors or fund managers can react quickly to market conditions, selling or buying based on economic trends, company news, or market signals. - Increased Costs

Since active investing involves frequent transactions, it usually comes with higher fees and trading costs. Additionally, actively managed funds often have higher expense ratios due to the research and expertise required. - Higher Risk

Attempting to beat the market means taking on more risk, which may lead to larger gains but can also result in significant losses.

Which Strategy is Best for Your Goals?

When deciding between passive and active investing, it helps to consider your goals, timeline, and risk tolerance:

- Long-Term Growth: If your goal is long-term wealth-building with minimal involvement, passive investing is likely a better choice. By investing in index funds or ETFs that track the market, you’re setting yourself up for gradual, steady growth over the years.

- Short-Term Gains: If you’re aiming for higher, short-term gains and are willing to take on more risk, active investing may be more suitable. Keep in mind, however, that it requires constant attention and an understanding of the market to avoid common pitfalls.

- Risk Tolerance: Passive investing is generally lower-risk because it focuses on the broader market, which tends to rise over time. If you’re more conservative or new to investing, passive may be the way to go. Active investing, on the other hand, may be suitable for those comfortable with higher risks.

- Time Commitment: Passive investing is less time-intensive and ideal for those with busy schedules or limited financial knowledge. Active investing, however, requires time, knowledge, and a willingness to stay updated on the market.

The Verdict: Passive or Active?

Ultimately, there’s no one-size-fits-all answer. Many investors actually use a combination of both strategies—passive investments for long-term growth and active investments to try and capture short-term gains. By diversifying your approach, you can balance the stability of passive investing with the potential gains of active investing.

Ready to Start Your Investment Journey?

Whether you’re interested in passive or active investing, platforms like eToro offer a user-friendly experience for investors at all levels. With eToro, you can explore a variety of investment options, including stocks, ETFs, and crypto. Start small, explore both strategies, and find the one that best aligns with your goals.

Start your investment journey with eToro today!

Disclaimer: Investment carries risk. Always conduct your own research.

Leave a comment